Vendor Reconciliation Process in Accounts Payable

For example, reconciling general ledger accounts can help maintain accuracy and would be considered account reconciliation. While reconciling your bank statement would be considered a financial reconciliation since you’re dealing with bank balances. The Ramp Card is an innovative corporate card, particularly suited for LLCs, that combines automated expense management features with 1.5% cashback rewards on purchases. It offers detailed spending insights with AI-powered recommendations for cutting costs, and integrates seamlessly with accounting software to simplify financial tracking and reporting. Cards come with no annual fees, foreign transaction fees, or card replacement fees. Ramp is an excellent choice for businesses that want to streamline their financial operations while saving money.

Credit cards

Account reconciliation is a process that involves identifying discrepancies between business ledgers and outside source documents. Accuracy and strict attention to detail are the fundamental principles of this process. Various factors, such as timing differences, missing transactions, and mistakes can cause these discrepancies.

Accounts Payable

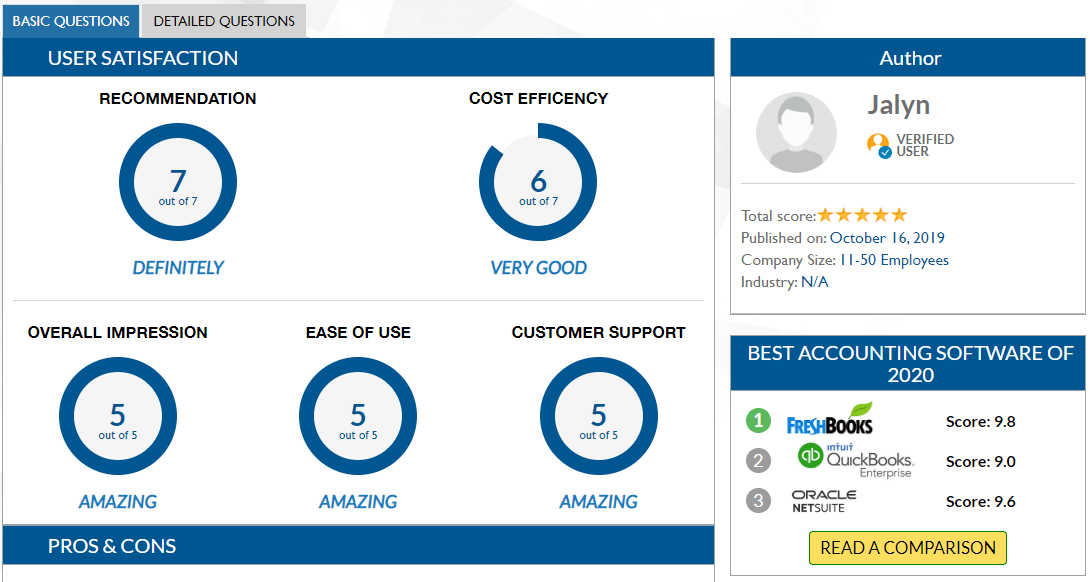

Accounts Payable teams must adhere to the important features of accurate, regular vendor reconciliation. By doing so, they can maintain good vendor relationships, detect fraud, and support audit trails. Vendor Reconciliation is a critical practice to ensure the company’s balances are correctly owed to the vendors. Same as businesses, individuals can also opt for either monthly or quarterly reconciliations. Monitor metrics such as time spent on reconciliation, number of errors found, and overall accuracy.

Accounts receivable

- However, anomalies that accountants cannot easily explain may indicate fraud or suspicious transactions.

- The charge would have remained, and your bank balance would have been $2,000 less than the balance in your general ledger.

- The cash column in the cash book shows the available cash while the bank column shows the cash at the bank.

- Keeping your accounts reconciled is the best way to make sure that your balances are accurate and an important part of ensuring adequate financial controls are in place.

Plus, we’ll offer useful best practices for reconciliation in accounting for lawyers to help make the process easier, more effective, and more efficient. The important thing is to establish internal processes for account reconciliation and adhere to those processes. Using the bank reconciliation example above, if your spending doesn’t take into account the $12,000 in outstanding checks, you can easily overspend available funds. Invoice reconciliation also compares two sets of documents for accuracy, but instead of ending balances, you’re comparing invoice details against a hard copy.

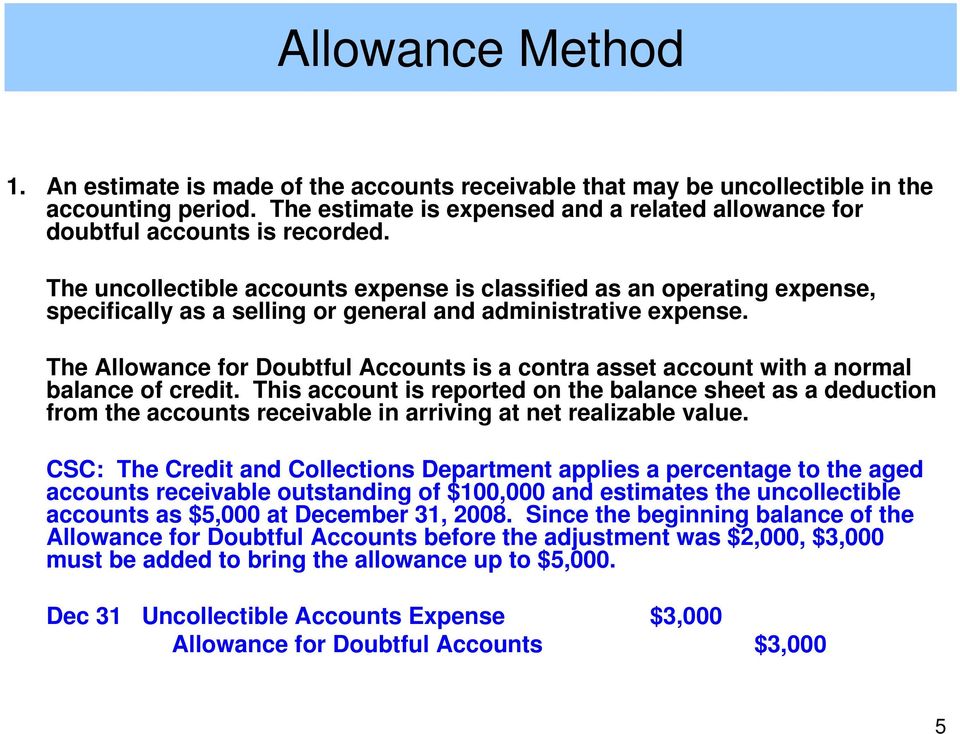

Parent companies carry out this type of reconciliation for their subsidiaries. It allows parent companies to consolidate the general ledgers of all their subsidiaries and identify and eliminate any intercompany flows that might arise in loans, deposits, and invoicing transactions. The vendor often does not automatically provide such statements at the end of each period so that businesses might request them. This allows businesses to ensure they can keep track of their payables correctly. Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. The primary use of reconciliation is to confirm the accuracy of financial accounts and identify any inconsistencies or mistakes.

How often should a company or business be ideally reconciling its accounts?

Note charges on your bank statement that you haven’t captured in your internal records. When reconciling balance sheet accounts, consider monthly adjusting entries relating to consolidation. This reconciliation process allows you to confirm that the records being compared are complete, accurate, and consistent. Regularly reconciling your accounts, especially bank accounts and credit defining take-home pay card statements can also help you identify suspicious activity and investigate it immediately, rather than months after it has occurred. And if you never reconcile your accounts, chances are that fraudulent activity will continue. For small businesses, the account reconciliation process helps identify potential misstatements and ensures the accuracy of financial statements.

For example, a grocery store dealing with daily cash transactions relies on daily cash reconciliations to manage cash flow effectively. In contrast, a consulting firm may find that monthly reconciliations for invoices and expenses are enough. Meanwhile, a construction company dealing with equipment and https://www.business-accounting.net/turntable-repair/ material costs may choose quarterly reconciliations to guarantee their financial processes operate smoothly. In most cases, account reconciliations are performed against the general ledger. This is because the general ledger is considered the master source of financial records for the business.

Similarly, when a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount. When the company pays the bill, it debits accounts payable and credits the cash account. Again, the left (debit) and right (credit) sides of the journal entry should agree, reconciling https://www.accountingcoaching.online/ to zero. Wave is a simple solution for very small businesses that need a place to consolidate bookkeeping records and invoices, but don’t have to log more than a handful of transactions each day. The free version of the accounting software lets you track income and expenses, send unlimited invoices and automatically send reminders for late online payments.

For example, if you run a small retail store, you may keep a point-of-sale ledger, or similar software, that records daily transactions, inventory, and in-store balances. You’ll also have an external bank account that tracks deposits, purchases, and long-term balances. When you compare the two, you can look for any discrepancies in cash flow for a certain time frame. Performing account reconciliation is crucial for businesses to avoid errors in their financial records and to prevent potential issues during audits. Most companies prefer to reconcile their accounts monthly after closing their financial books. Legal software for trust accounting can help you track transactions and reconcile records and bank statements.

Today, most accounting software applications will perform much of the bank reconciliation process for you, but it’s still important to regularly review your statements for errors and discrepancies that may appear. Account reconciliation is done to ensure that account balances are correct at the end of an accounting period. The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process.

Leave a Reply